Quick Takeaways

- SK Innovation Ford battery joint venture exit leads to a USD 2.6 billion asset impairment amid changes in U.S. EV incentives.

- SK On will continue operating the Tennessee battery plant while Ford assumes control of Kentucky facilities.

On January 28, SK Innovation disclosed during its fourth-quarter 2025 earnings call that the termination of the SK Innovation Ford battery joint venture in the United States resulted in an asset loss of KRW 3.7 trillion, equivalent to USD 2.6 billion.

The company attributed the impact to the conclusion of U.S. electric vehicle tax credits, which weighed on quarterly profitability despite higher battery shipments to Europe.

Asset Impairment Linked to U.S. EV Policy Changes

The loss was recorded as a one-time impairment reflecting the restructuring of battery manufacturing operations tied to Ford’s electric vehicle strategy.

According to the company, the reduced incentive environment in the U.S. significantly altered the financial outlook of the joint venture, accelerating the decision to unwind the partnership.

Operational Split Between Kentucky and Tennessee Facilities

Ahn Kun, head of planning and coordination at SK On, stated that the Tennessee plant is scheduled to begin production in 2028, focusing on storage cells and batteries for Ford’s extended-range electric vehicles.

BlueOval Project Concludes Earlier Than Planned

The companies had announced the end of the BlueOval project in December, marking an early conclusion to an initiative unveiled just four years earlier.

Financial Impact and Balance Sheet Improvement

Kim Youngkwang, head of financial management at SK On, emphasized that the loss represents a one-time accounting adjustment.

The restructuring allows SK Innovation to streamline its battery business exposure in the U.S. while continuing selective production through SK On, aligning future investments with evolving EV demand and policy conditions.

The company attributed the impact to the conclusion of U.S. electric vehicle tax credits, which weighed on quarterly profitability despite higher battery shipments to Europe.

Asset Impairment Linked to U.S. EV Policy Changes

The loss was recorded as a one-time impairment reflecting the restructuring of battery manufacturing operations tied to Ford’s electric vehicle strategy.

According to the company, the reduced incentive environment in the U.S. significantly altered the financial outlook of the joint venture, accelerating the decision to unwind the partnership.

Operational Split Between Kentucky and Tennessee Facilities

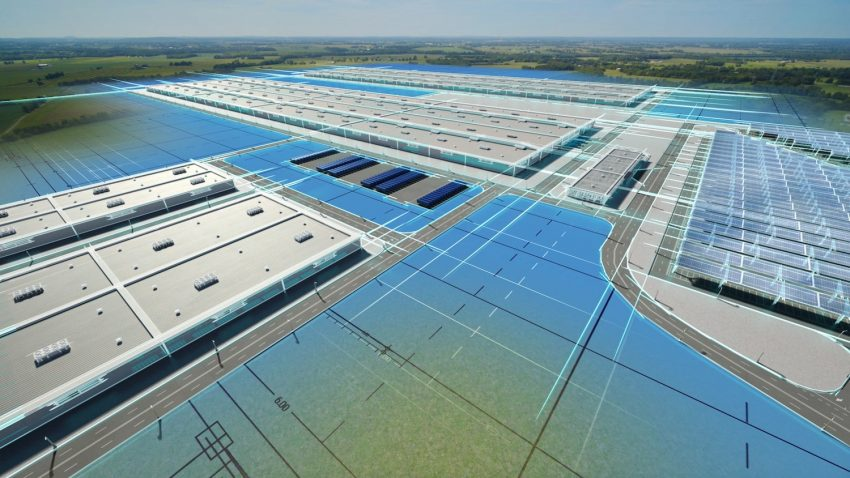

- Under the revised arrangement, Ford Motor Co. will assume ownership and operational control of the joint venture’s two battery plants located in Kentucky.

- Meanwhile, SK Innovation’s battery subsidiary SK On will continue to operate the Tennessee facility.

Ahn Kun, head of planning and coordination at SK On, stated that the Tennessee plant is scheduled to begin production in 2028, focusing on storage cells and batteries for Ford’s extended-range electric vehicles.

BlueOval Project Concludes Earlier Than Planned

The companies had announced the end of the BlueOval project in December, marking an early conclusion to an initiative unveiled just four years earlier.

- The original plan involved an investment of USD 11 billion to develop three battery manufacturing plants alongside an EV pickup assembly facility in the U.S.

Financial Impact and Balance Sheet Improvement

Kim Youngkwang, head of financial management at SK On, emphasized that the loss represents a one-time accounting adjustment.

- As part of the transition, Ford will assume both assets and liabilities associated with the Kentucky operations.

The restructuring allows SK Innovation to streamline its battery business exposure in the U.S. while continuing selective production through SK On, aligning future investments with evolving EV demand and policy conditions.

Company Press Release

Click above to visit the official source.

Share: