Quick Takeaways

- Canada China EV trade deal signals a strategic shift in Canadian trade policy.

- Canada China EV trade deal aims to balance EV affordability with industry protection.

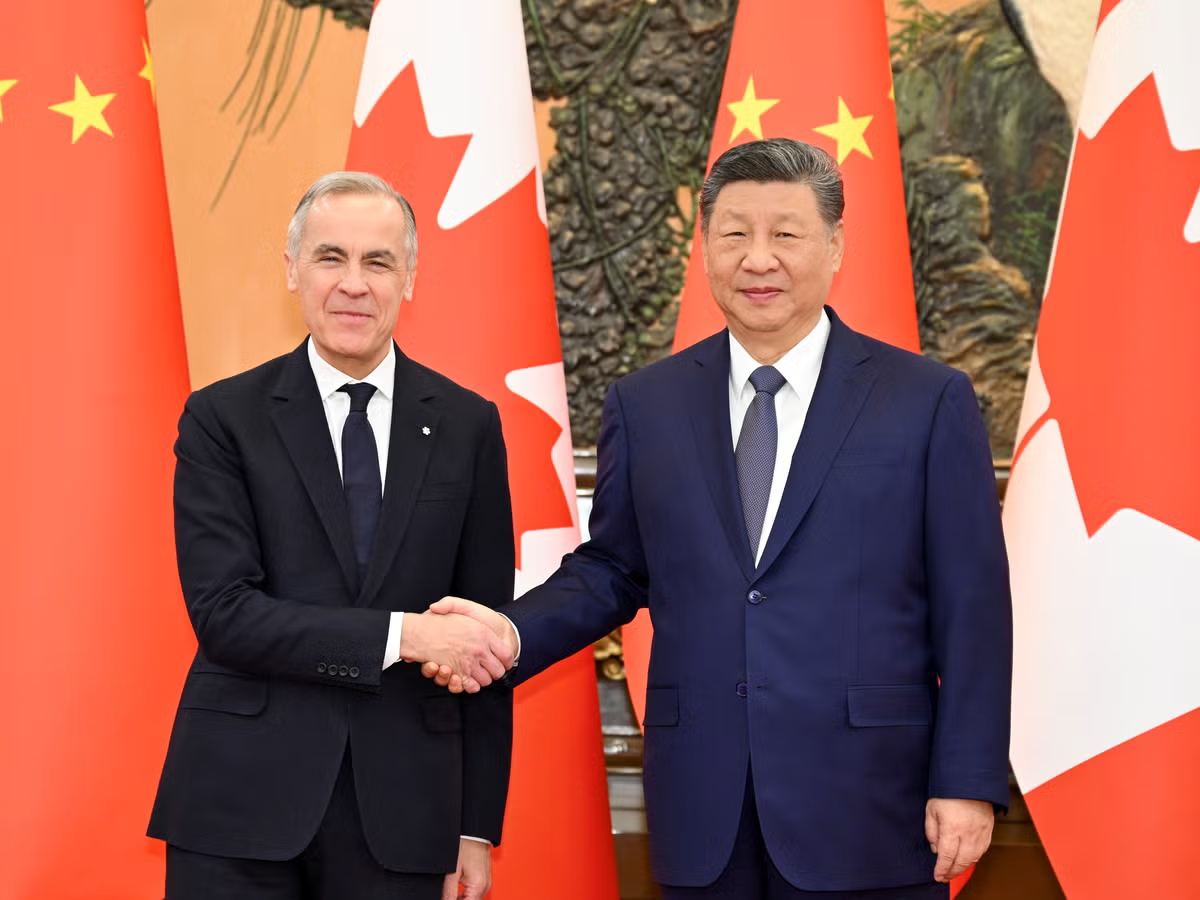

On January 16, Canadian Prime Minister Mark Carney announced a Canada China EV trade deal that will permit up to 49,000 Chinese electric vehicles to enter Canada annually at a 6.1% tariff, while reducing Canadian duties on Chinese canola products to 15% by March.

The agreement was described by Carney as preliminary but landmark, framing it as part of a broader effort to dismantle trade barriers and recalibrate tariffs. The Canadian Government is positioning the deal within a wider strategy to double non-U.S. exports and lift exports to China by 50% by 2030.

Speaking in Beijing, Carney said the partnership reflects current global realities and is grounded in pragmatic, interest-based engagement. He added that Canada’s relationship with China has become more predictable compared to its increasingly complex trade dynamics with the United States.

Canada China EV Trade Deal and Market Impact

Carney stated that the Canada China EV trade deal would improve affordability of electric vehicles for Canadian consumers. He emphasized that the approved import volume represents roughly 3% of the domestic market, limiting immediate disruption while expanding consumer choice.

Key elements of the arrangement include:

Industry and Political Reactions in Canada

The announcement triggered sharp criticism from Ontario Premier Doug Ford, who warned that the deal could lead to an influx of low-cost Chinese EVs without firm commitments to invest in Canada’s auto sector or supply chain. He also cautioned that the move could undermine Canadian automakers’ access to the U.S. market.

Echoing industry concerns, Canadian Vehicle Manufacturers’ Association CEO Brian Kingston said he was deeply disappointed by the decision, highlighting the risks of opening the market to Chinese electric vehicles during a sensitive period for North American manufacturing.

USMCA Context and Global Trade Tensions

The Canada China EV trade deal comes as the United States-Mexico-Canada Agreement undergoes renegotiation. The timing is notable, arriving days after Donald Trump reiterated calls for Chinese automakers to invest directly in U.S. manufacturing and employ American workers.

In 2024, Canada aligned with U.S. and European measures by imposing 100% tariffs on Chinese EVs, citing threats to the North American auto industry. Additional 25% import taxes were placed on steel and aluminum, intensifying trade friction.

China responded in March 2025 with 100% tariffs on Canadian canola oil, peas, and other agricultural products. Against this backdrop, the Canada China EV trade deal marks a significant policy shift, balancing trade diversification goals with domestic industry protection as Canada redefines its role in the global EV landscape.

The agreement was described by Carney as preliminary but landmark, framing it as part of a broader effort to dismantle trade barriers and recalibrate tariffs. The Canadian Government is positioning the deal within a wider strategy to double non-U.S. exports and lift exports to China by 50% by 2030.

Speaking in Beijing, Carney said the partnership reflects current global realities and is grounded in pragmatic, interest-based engagement. He added that Canada’s relationship with China has become more predictable compared to its increasingly complex trade dynamics with the United States.

Canada China EV Trade Deal and Market Impact

Carney stated that the Canada China EV trade deal would improve affordability of electric vehicles for Canadian consumers. He emphasized that the approved import volume represents roughly 3% of the domestic market, limiting immediate disruption while expanding consumer choice.

Key elements of the arrangement include:

- Annual cap of 49,000 Chinese EV imports

- Reduced tariff rate of 6.1% on approved EVs

- Gradual easing of duties on Canadian canola exports to China

Industry and Political Reactions in Canada

The announcement triggered sharp criticism from Ontario Premier Doug Ford, who warned that the deal could lead to an influx of low-cost Chinese EVs without firm commitments to invest in Canada’s auto sector or supply chain. He also cautioned that the move could undermine Canadian automakers’ access to the U.S. market.

Echoing industry concerns, Canadian Vehicle Manufacturers’ Association CEO Brian Kingston said he was deeply disappointed by the decision, highlighting the risks of opening the market to Chinese electric vehicles during a sensitive period for North American manufacturing.

USMCA Context and Global Trade Tensions

The Canada China EV trade deal comes as the United States-Mexico-Canada Agreement undergoes renegotiation. The timing is notable, arriving days after Donald Trump reiterated calls for Chinese automakers to invest directly in U.S. manufacturing and employ American workers.

In 2024, Canada aligned with U.S. and European measures by imposing 100% tariffs on Chinese EVs, citing threats to the North American auto industry. Additional 25% import taxes were placed on steel and aluminum, intensifying trade friction.

China responded in March 2025 with 100% tariffs on Canadian canola oil, peas, and other agricultural products. Against this backdrop, the Canada China EV trade deal marks a significant policy shift, balancing trade diversification goals with domestic industry protection as Canada redefines its role in the global EV landscape.

Industry reports & Public Disclosures | GIA Analysis

Click above to visit the official source.

Share: